Key Takeaways

- Similar to gold-ETFs, all of the gold-backed cryptocurrencies on the market are centralized. This means they have counterparty risk. Unlike storing your own physical gold, gold-backed cryptocurrencies require you to trust a company for storage.

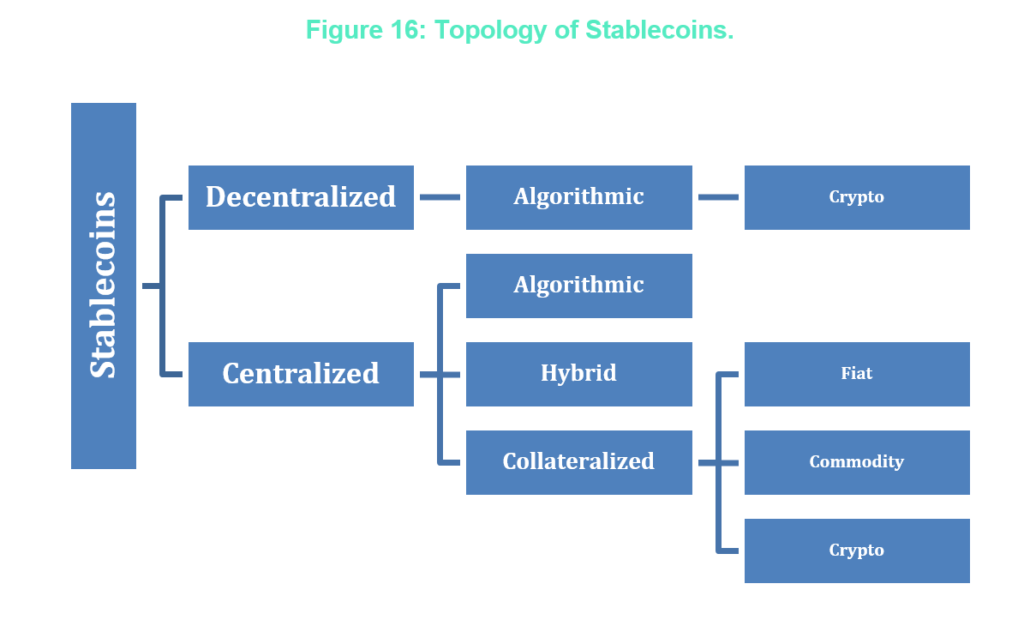

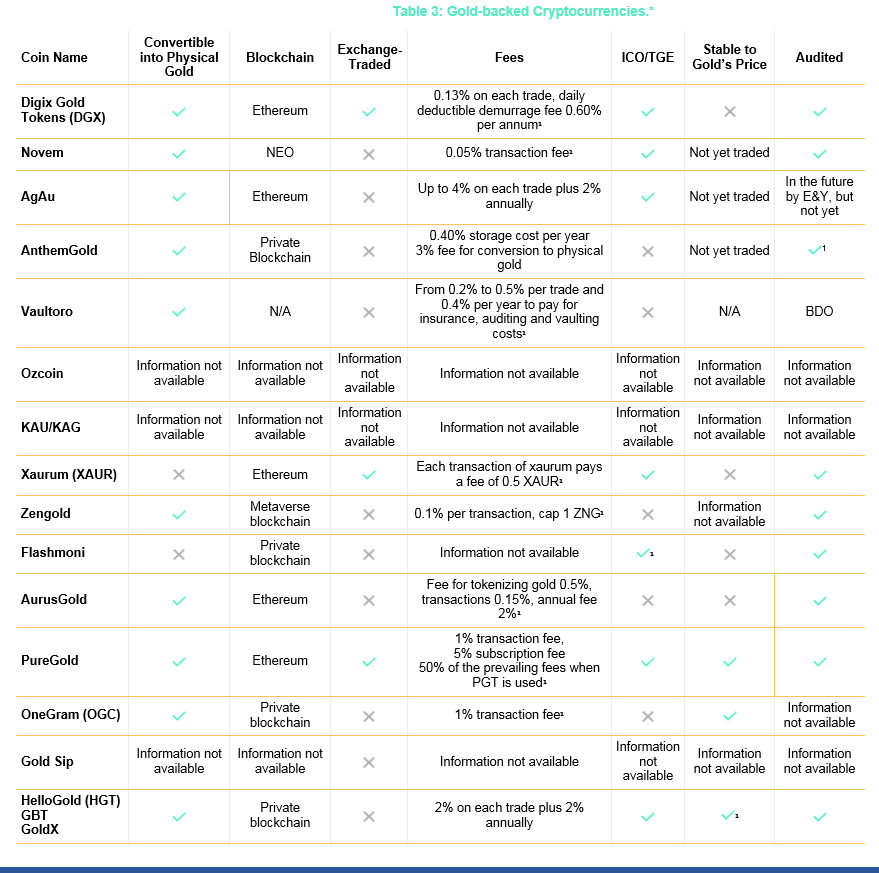

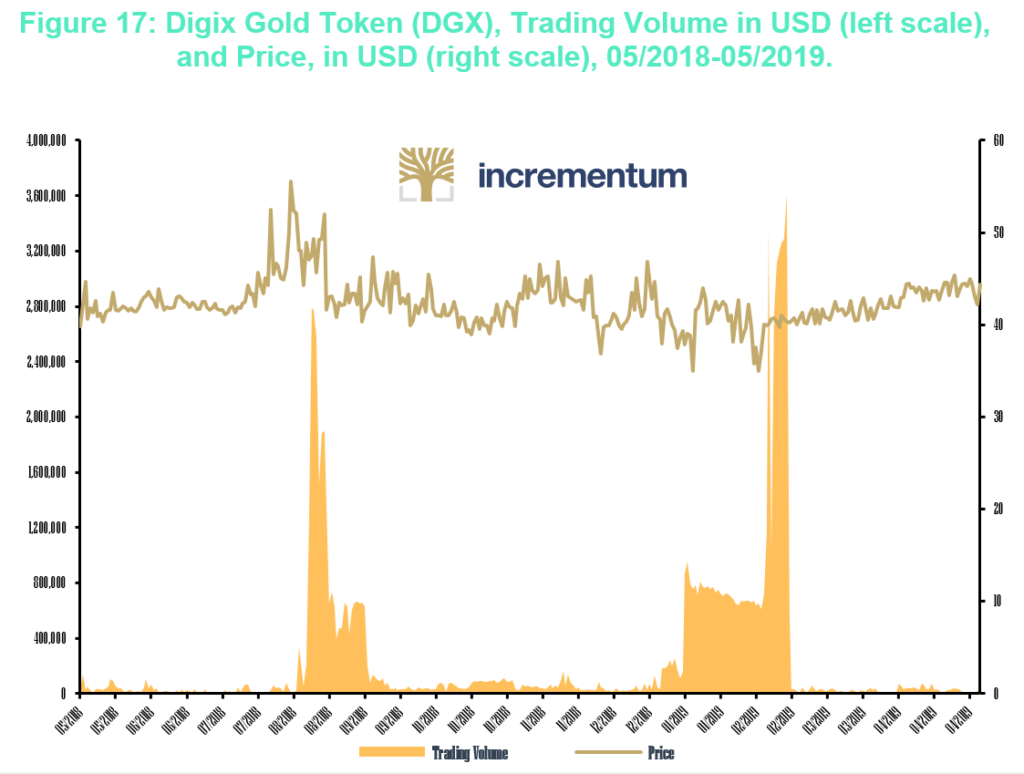

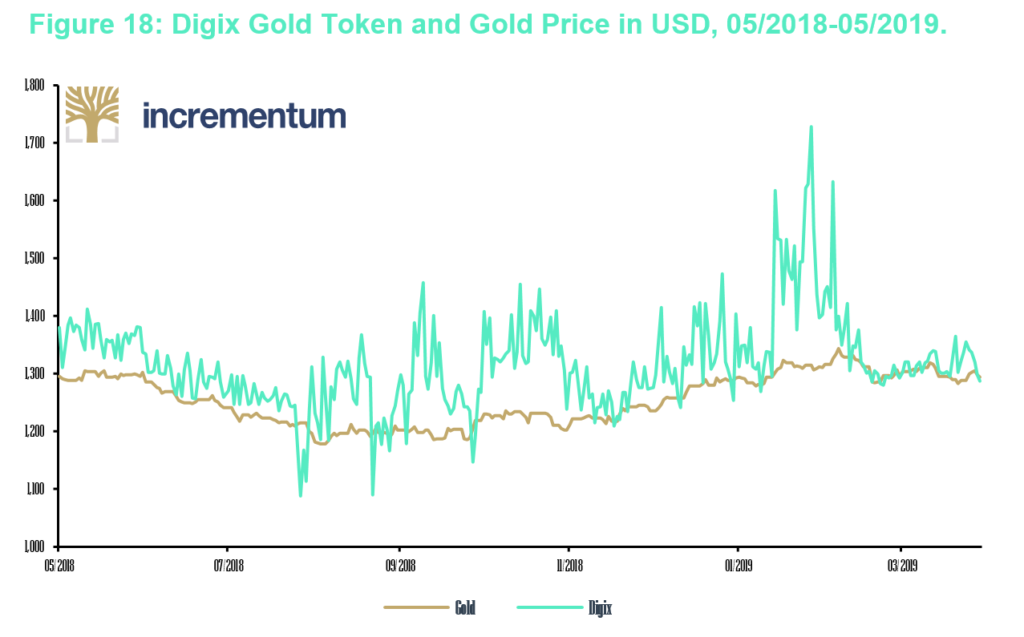

- There are three main types of centralized, collateralized stablecoins: fiat, commodity, and crypto. Gold-backed cryptocurrencies are considered to be centralized and “off-chain-backed coins.” The most famous gold-backed cryptocurrency is the Digix Gold Token (DGX). DGX has a market capitalization of approximately USD 4mn and a daily trading volume of approximately USD 240,000 over the past year. Even though Digix is backed by gold, it often trades at a discount to gold, and Digix’s return is extremely volatile compared to gold’s return.

- Gold-backed cryptocurrencies have higher costs and risks than ETFs and managed gold funds. Investors can suffer loss of value due to faulty private key storage, double-spends from weak blockchain security, regulatory uncertainty, lack of liquidity, and non-transparent accounting of gold vaults.

- The first version of this article originally was published in the sister report of this publication, the In Gold We Trust report 2019. Interested readers can download the publication here: https://ingoldwetrust.report/

Last year in the sister report of the Crypto Research Report called In Gold we Trust, we featured an article exploring the intersection between gold and Bitcoin. The article focused on how gold impacts Bitcoin’s application as a global store of value. Now an even newer competitor to gold is emerging: stablecoins. Stablecoins promise to improve on gold by being digital and to improve on Bitcoin by being stable. But can the companies behind these stablecoins deliver or are they just modern alchemists? This chapter gives a rundown of the stablecoin market with a focus on gold-backed stablecoins, which are in many ways similar to gold ETFs. Bottom line: All of the gold-backed stablecoins on the market are centralized, which means they have counterparty risk. Unlike storing your own physical gold, trusting a company to store your gold is required.

Gold and Bitcoin

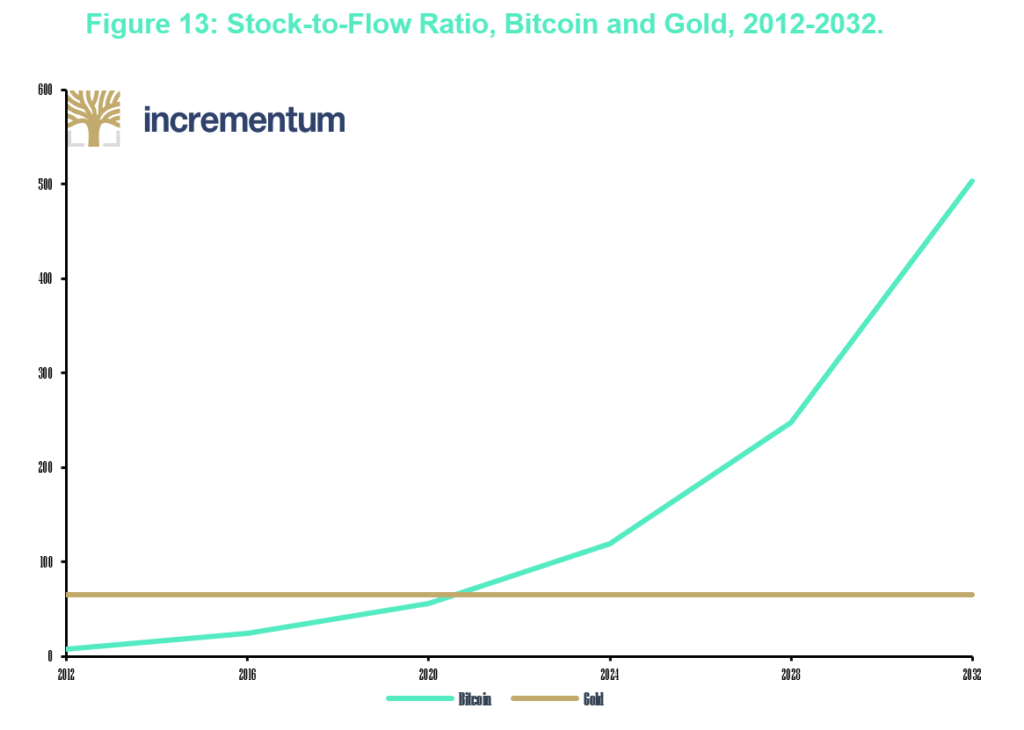

Gold has fascinated mankind for thousands of years. So far, more than 190,000 tons of the precious metal have been mined. How much is still underground remains unknown. One thing is clear, however: The extractable quantity is finite and subject to diminishing returns. Similarly, the number of bitcoins that can be mined is limited: The mysterious inventor of Bitcoin has set the maximum amount to 21 million coins. Unlike fiat money, gold and Bitcoin cannot be created by central banks at will in response to demand shocks. While the average annual growth rate of the gold supply is around 1.7 % with a rather small standard deviation, Bitcoin’s inflation rate is currently 3.69 % and on a downward trajectory. As mentioned in last year’s In Gold We Trust report, the supply of newly mined bitcoins follows a preprogrammed, transparent, and predictable schedule, which remains unaffected by fluctuations in demand. Their inelastic supply makes the prices of gold and Bitcoin dependent on their demand.

Overall, the supply trajectories of Bitcoin and gold show that Bitcoin is expected to have a lower inflation rate by 2021. Every 210,000 blocks, the reward the miners receive per block is halved. This roughly corresponds to a four-year “half-life.” Observers pay very close attention to the schedule, because the so-called “halving” is regarded as an important indicator of price movement. There is only little experience so far, since there have been only two such “halvings.” But they show that the price has always risen in the months before the actual event. Specifically, the Bitcoin price found its bottom in the first bear market that came 378 days before the first halving and again in the second bear market, 539 days before the second halving.

This equals an average of 458 days, and we are currently approximately 350 days from the next halving, which will probably take place towards the end of May 2020. If the pattern observed so far is confirmed, the bottom should have occurred somewhere between December 2018 and May 2019.

When we compare the supply of gold to the supply of Bitcoin, we notice that both are being mined, albeit in their own particular ways. Gold can be found in soil, rivers, and rocks all over the world, regardless of borders. Similarly, independently of their location, Bitcoin miners receive a reward for providing the network with computing power to verify and settle transactions. The main difference when it comes to mining is that mining is what secures the Bitcoin network and the price of Bitcoin on the market. In contrast, gold mining does not secure the price of gold. Therefore, we would like to make the subtle distinction that Bitcoin is not a bearer instrument in the same sense that gold is. Paying with gold requires absolutely no dependence on a network for settlement. However, Bitcoin transactions can take hours to settle; and trusting the software, hardware, and internet that support Bitcoin is a type of counterparty risk even though the “party” is not human.

To make Bitcoin and gold even more scarce, a certain amount of Bitcoin and gold becomes unusable every year. Previously, gold was used in quantities that made smelting and recovery cost-effective and common. For example, the gold in your mother’s necklace may well have in it metal mined by the Romans, then used by the Tudors, etc. Now we see gold used in tiny amounts in high-tech goods, amounts that may not be cost-effective to salvage for a long time. The British Geological Survey estimates that around 12% of current world gold production is being lost for this reason.This means gold is being consumed in an absolute sense for the first time in history. Again, this is similar to Bitcoin’s annual loss of coins that are unspendable due to lost private keys and fat-finger mistakes while typing cumbersome recipient addresses. Two different cryptocurrency researchers, Chainanalysis and Unchained Capital, have created an upper bound of 3.8 million for the total number of Bitcoins lost. Overall, the supply trajectories of Bitcoin and gold show that Bitcoin is expected to have a lower inflation rate by 2021.

Does Bitcoin Hurt Gold?

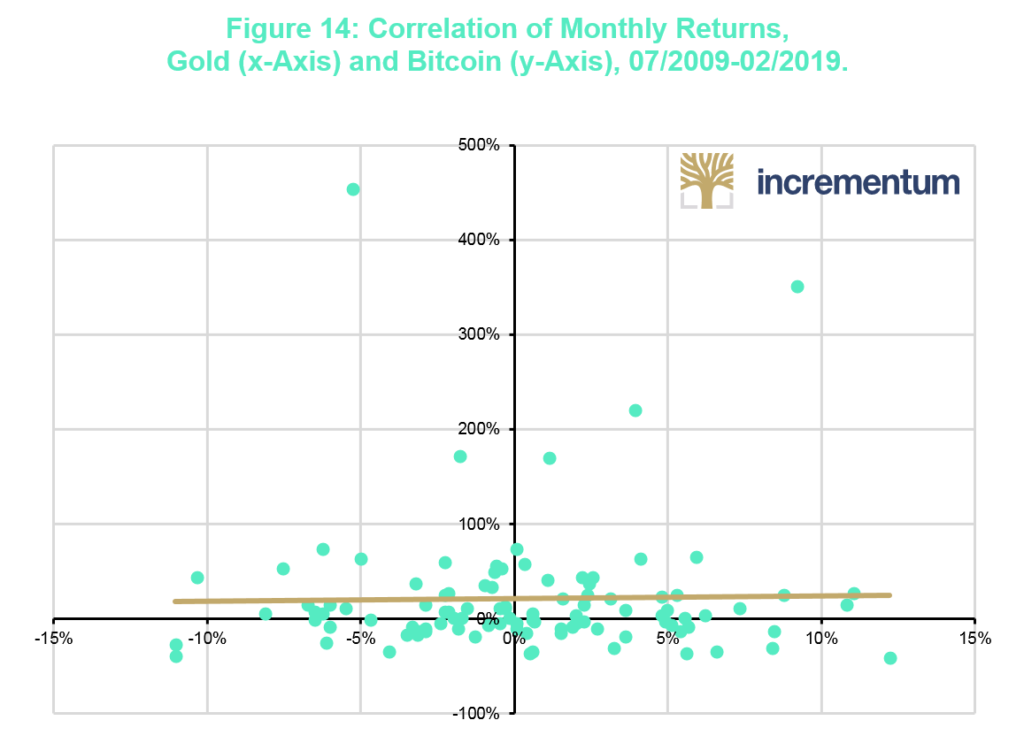

Since many young investors consider Bitcoin to be digital gold with a payment option, some may suspect that the demand for gold is adversely affected by the success of cryptocurrencies. As of yet, the correlation between gold and Bitcoin returns is still low and slightly positive, indicating that the demand for gold is not adversely affected by cryptocurrencies.

This secure demand strength of gold is due to the unique advantages it has over Bitcoin. First, gold is far less volatile than cryptocurrencies and will remain so for the time being. In 2017, Bitcoin was about 15 times more volatile than gold. In addition, gold is much more liquid. On average, USD 2.5bn in Bitcoin is traded daily.[11] This amounts to just 1% of the total gold market: The daily trading volume of gold is around USD 250bn. Furthermore, gold trades in regulated and well-established venues and has long been accepted by institutional investors as an investment alternative. This is not the case for cryptocurrencies.

Leveraging Gold’s Stability

The US dollar’s hegemony is under increasing pressure from China and Russia, as US national debt reaches record highs. Instead of returning to a gold standard in support of a fiat currency, the 21st century could witness the emergence of a gold standard involving a cryptocurrency.

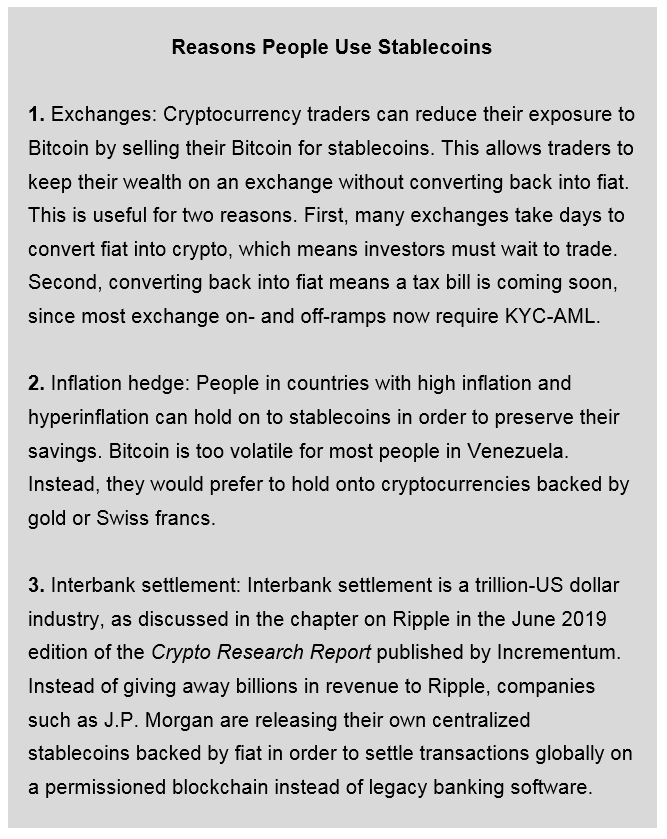

The notion of a monetary system based on a cryptocurrency may be surprising, given the fact that cryptocurrencies are the most volatile asset class. Many Bitcoin holders have experienced a ride from USD 1,000 right up to USD 20,000, and then steadily back down, culminating in a long, choppy sideways market followed by the recent rally to USD 8,000. Enter stablecoins.Stablecoins promise to offer all of Bitcoin’s benefits while fixing the problem of volatility.

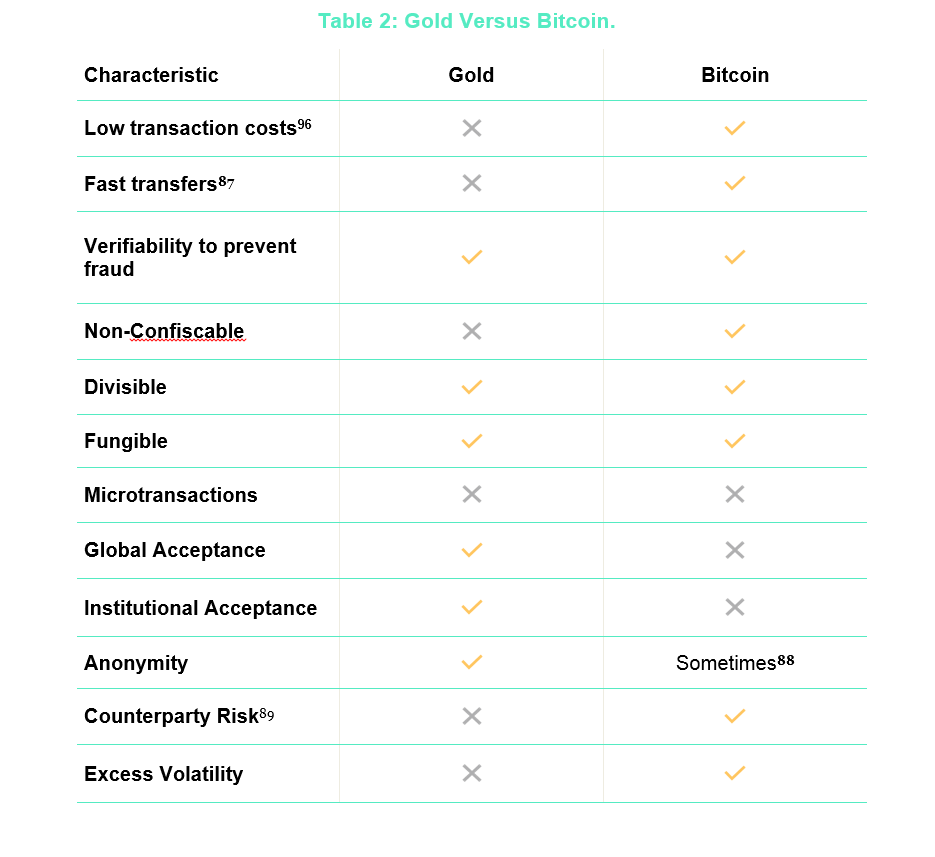

While the decentralized and independent nature of their supply makes gold and Bitcoin good stores of value, there are major differences with respect to other monetary features. Following Dobeck and Elliott and Berentsen and Schär, the next table gives a quick overview.

However, the promise is most likely to be optimistic, as promises often are in the cryptocurrency space. For several decades, countries around the world have tried to peg their exchange rates to other more stable currencies. Not a single fixed peg has lasted in the long run.

Take for example the European Exchange Rate Mechanism (ERM), which attempted to keep the plethora of European currencies within a narrow band of each other during the ‘80s and ‘90s. Since the UK could not keep their print presses turned off, George Soros and other speculators were able to mount a speculative attack and profit from breaking the peg. This is because whenever a currency holds fractional reserves, arbitrage opportunities arise between it and other currencies. Therefore, stablecoins that are not fully backed are trading off between stability in the short run and blow-up risk in the long run, because keeping a fixed peg without investing in the underlying asset makes the peg fragile to black swan events.

However, Bitcoin is volatile, and many cryptocurrency users are now demanding stability. To meet this demand, the new stablecoins are combining the advantages of gold and Bitcoin. Gold-backed stablecoins are similar to gold ETFs. For example, the most famous gold ETF, SPDR Gold Shares (GLD), is a fund that buys physical gold and divides the ownership of it into shares.

In theory, gold-backed cryptocurrencies are supposed to work the same way. However, there are currently no cryptocurrency exchanges that are licensed to trade tokenized ETFs.Even if regulators eventually approve an application for such an exchange, they will require KYC/AML on each transaction. This begs the question: How is a centralized gold-backed stablecoin any better than a gold ETF? We have still not found a suitable answer to this question. In fact, the solution seems inferior at first glance, because investors still have to safely protect the private keys that control the gold-backed stablecoins, and if the tokens are traded on a public blockchain like Ethereum, then the coins will be subject to volatile and increasing transaction fees when they send and receive the gold tokens. Then there are all of the problems associated with public blockchains, such as latency, lack of scalability, and security.

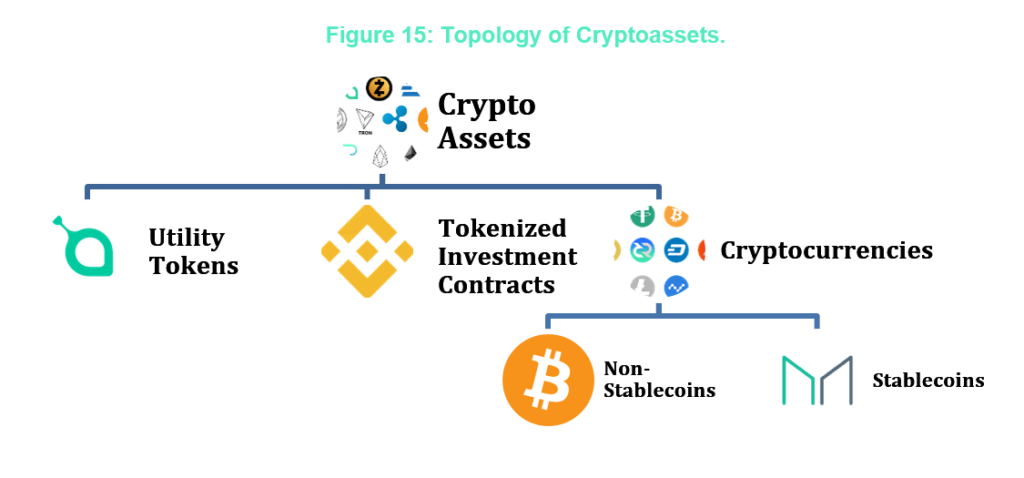

As shown on the next figure, there are three main types of collateralized stablecoins: fiat, commodity, and crypto. Gold-backed cryptocurrencies are considered to be centralized “off-chain-backed coins” because they generate value by a counterparty’s depositing gold, gold certificates, or other gold-related securities into a vault. Similar to fiat-collateralized coins like the infamous Tether, gold-backed cryptocurrencies are supposed to be listed on cryptocurrency exchanges so that gold positions can be opened and closed within seconds by retail and professional investors alike.

Gold-Backed Stablecoins

Over 50 cryptocurrencies are somehow backed to gold. The next section summarizes just a handful of the gold-backed projects. The projects selected were drawn from responses to an official @CryptoManagers tweet on Twitter. We asked our followers what coins they wanted to learn more about. We also selected a few coins from the German-speaking countries, including Vaultoro, Novem, and AgAu. Finally, we have included an update on the gold-backed tokens that we covered last year.

*Please be advised that the table includes fees such as transfer fees, custody fees, subscription fees, and redemption fees. We included all information which was provided to us by the companies. However, a substantial cost that investors will have to bear may be the spread between the price of gold on the market and the price of gold that each company charges investors. This markup on the price of gold is often not stated clearly in the whitepaper. The table is not complete because the information was unavailable. Readers are responsible for their own due diligence on each firm, and this is not investment advice.

Digix Gold Tokens (DGX)

There are two tokens associated with this company: DGD and DGX. The DGD crowdsale in March 2016 was the first crowdsale and major DAO hosted on the Ethereum network. A decentralized autonomous organization (DAO) is a type of decentralized application (dApp) that allows owners to make business decisions by voting electronically, and execution of the business decisions is performed using smart contracts. The second is the DGX token, which equals one gram of standard gold. The company reportedly procures its gold from LBMA-approved refiners. The tokens are issued by Pte. Ltd. in Singapore, and the gold is stored at The Safe House in Singapore. As you can see in the next chart, the daily trading volume is approximately USD 243,000 over the past year, and USD over the past month. The next chart shows that the Digix Gold Token is not correlated with the price of gold. The token is more volatile and often trades at a discount to gold.

AnthemGold

What makes AnthemGold unique is that it is the first insured, fully gold-backed stablecoin based in the US. The token is open to citizens of 174 countries, and the vault where the gold is stored can be viewed on video, on the AnthemGold homepage. Currently, there are 20kg of gold there. The gold is insured through Lloyd’s; there is zero FACTA reporting required for investors; and according to the founder of AnthemGold, Anthem Blanchard, the gold has zero risk of bank deposit freeze or closure. There is a 0.40 % storage cost per year, extracted from metal (which is the same as the GLD gold ETF fee structure).

AgAu

AgAu is a gold-backed token that is being developed by Thierry Arys Ruiz and Nicolas Chikhani, the former CEO of Arab Bank in Geneva. Their offices are located at the Zug-based blockchain incubator, Crypto Valley Venture Capital (CV VC). Their coin will be audited by E&Y and built as an ERC-1400 smart contract on the Ethereum blockchain. The gold is 1 kg LBMA bars stored at Trisuna in Liechtenstein. AgAu will be engaging in a token generation event (TGE) to raise the initial round of capital that will be used to buy the gold required for backing the tokens. The storage fees are 0.2 % per annum, and each transaction has a maximum total cost of 0.4 %.

HelloGold

HelloGold, a Malaysian-based company founded in 2015, offers a token backed by 1 gram of 99.99 % investment-grade gold. The tokens can be converted into physical PAMP Suisse gold, and the shipping is insured. The total GBT supply is limited to 3,800,000 (representing 3.8 tons of gold). Users also have the opportunity to convert their gold into a digital gold token (GBT) if they have a “pro” account, which requires standard AML/KYC. This enables them to use the stored gold as a value outside the HelloGold system.

In addition, people may use their gold as collateral for loans made available by Aeon Credit Services, giving them access to personal finance. Finally, HelloGold offers a Smartphone app with which users can trade their tokens and exchange them for their corresponding shares of investment-grade gold. When they redeem their GBTs for physical gold, they receive the corresponding amount in bullion, coins, or jewelry via recorded mail.

GBT accounts are charged an annual fee of 2 %. Interestingly, the HelloGold blockchain operates on a private network to reduce fees and transaction latency and avoid the risk of independent developers adding their own contracts to the blockchain. This means that HelloGold and its nodes control block times as well as the execution of the gold transactions.

Due Diligence on Gold-Backed Stablecoins

- Can the cryptocurrency be converted into physical gold on demand? How easy is the process?

- Does the company disclose how it stores the gold?

- Who is storing the gold that backs the cryptocurrency? Is that company trustworthy?

- Is the gold insured?

- Does the company have a well-known and reputable auditor? If the company is not audited, then it can easily issue more tokens than gold, thereby creating fractional reserves.

- What happens if the company goes bankrupt? Is it a limited liability company that could leave investors empty-handed?

- What blockchain are the gold tokens built on? Is that blockchain secure?

- Do you know how to store the private key to the wallet that controls the gold tokens? What happens if you lose the key? What happens if the key is stolen?

- Gold-backed cryptocurrencies are similar to ETFs, which may make them subject to securities laws in Europe and the US. Is the company selling the cryptocurrency regulated? Does it store the gold in a country that has approved their token?

- Where can the gold-backed token be traded? Gold ETFs are traded on exchanges, but there are currently no cryptocurrency exchanges that are licensed to trade tokenized ETFs.

- How much liquidity does the gold-backed cryptocurrency have? Can you really close a position in case of a liquidity trap? The largest gold-backed cryptocurrency, Digix Gold Token, has a small daily trading volume of USD 243,000 over the past year, and USD 27,000 over the past month.

- What is the total expense ratio for the tokenized shares of the gold fund? The most famous gold ETF, SPDR Gold Shares, has a management expense ratio (total fund costs / total fund assets) of only 0.40 %.

- What is the business model of the coin? How do the people who created the coin make money? If there is not a clear way that they are profiting, then be suspicious of indirect costs or high risk.

Conclusion

A gold-backed cryptocurrency promises to be digital gold: no weight and stable. However, no one has figured out yet how to make a decentralized gold-backed stablecoin. All gold-backed stablecoins are centralized in the sense that you have to trust someone to store the gold for you. Similar to an exchange-traded gold fund, gold-backed stablecoins have counterparty risk. In the cryptocurrency world they say, “Not your keys, not your crypto.” Well, the parallel for gold would be something like, “Not your vault, not your gold.”

Backing a cryptocurrency in a way that an intermediary is required – a custodian or a bank for instance – actually conflicts with one of Bitcoin’s central tenets, namely, that users do not have to trust any intermediary. The security of Bitcoin and other cryptocurrencies is based on cryptographic technology. In contrast, the gold-token projects we have presented above are managed by real companies. They are responsible for the safekeeping of the gold. Therefore, the user has to trust that no state or private actor will be able to steal or confiscate the gold from the vaults.

Furthermore, the coins are often traded on a public blockchain structure such as Ethereum, which means the coins also suffer from all of Ethereum’s problems, such as scalability and security. Finally, there are over fifty gold-backed coins currently, and most likely, many of them will fail. It will take a few years for the market leaders to emerge, gain widespread exposure, and thus secure the standing of gold-backed tokens as a store of value. This year will be pivotal in identifying which projects are going to take the lead in this endeavor.