Table of Contents

-

Stablecoins: their pros and cons

-

Fiat problems

-

Gold-backed stablecoins

-

Conclusion

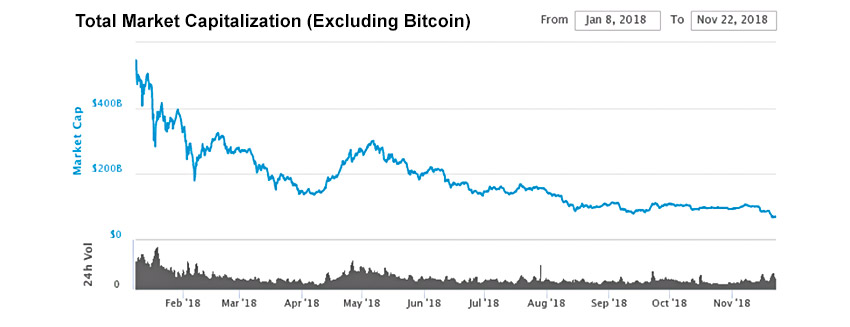

For everyone in crypto, 2018 was a rough year – the bear market took a big chunk off the crypto portfolio and several coins lost more than 90 per cent of their initial value.

No one wants to lose money, which is why the popularity of stablecoins has recently surged. A lot of new stablecoins have been released, with a lot more to come and 2019 may be the year of stablecoins. Stablecoins allow humans to escape market volatility to the security of asset-backed cryptocurrencies.

Yet stablecoins have a problem: all of them are backed by the dollar, and we could be on the brink of another global recession and significant economic decline. No-one knows what is going to happen in 2019. Is it safe to rely on fiat-backed stablecoins?

Stablecoins: their pros and cons

You can classify all stablecoins into three categories:

- Fiat-backed stablecoins – The most common collateral here is USD, and each token (usually an ERC20 token) is sponsored by 1 currency unit deposited in the issuer’s bank accounts.

2. Distributed stablecoins – These tokens are designed to achieve US dollar stability through mathematical algorithms, using collateral deposited in the network and maintaining enough physical assets to support all stablecoins released.

3. Stablecoins backed by precious metals – A particular quantity of gold or silver collateralizes each token.

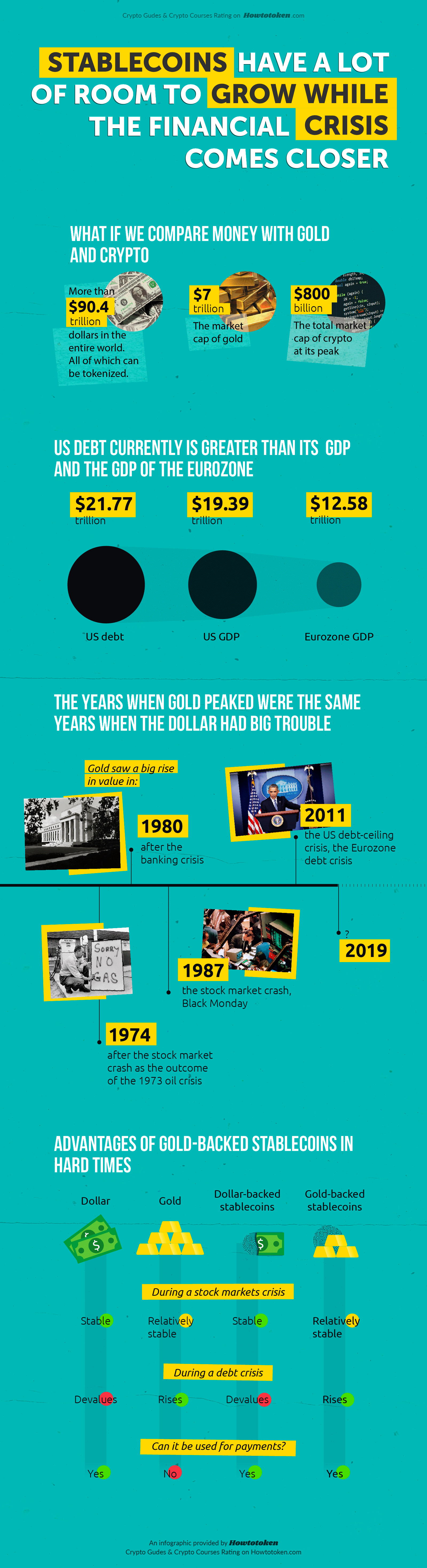

We’ve created an infographic to better explain this idea to you:

Conclusion

Why are Stablecoins getting so much attention? Since people continuously fear that the economy crashes. So, people want a little island of protection in the uncontrolled ocean of crypt where they can still bring their feet in.

Stablecoins could turn into the next big thing. Huobi and OKEx announced new stablecoins, and also added Circle’s USDC to Coinbase, the largest authorised exchange in the US. There’s a lot more to come in the future too – the London Block Exchange is expected to launch a pound-backed stablecoin, LBXPeg, Mongolia’s largest telecom company will issue a regulator-approved Candy stablecoin, and Stronghold (a financial firm) is also preparing to issue its own Stablecoin.

Binance recently reported two new stablecoins and its CEO wrote, “Controlled stable coins act as a middle ground where regulators retain power, yet the token also provides users with much more flexibility than conventional fiat.” Not everyone on crypto markets is there for decentralization, some people find it to be the normal market where they can exchange – and they are happy to see that they can sleep at night by keeping money in some assets.

Stablecoins can have blockchain network functionality – transparency and speed combined with confidence, as they will have anything to back them up in the event they fail. It is a quality which will be highly respected in these periods of confusion.